What Is the Tariff Dividend?

President Donald Trump has announced plans to distribute at least $2,000 to most Americans—excluding high-income earners, funded by revenues collected from tariffs imposed on foreign imports. He claims this “tariff dividend” is a direct result of his aggressive trade policies, which he argues have made the U.S. economy “the richest and most respected in the world”.

This proposal is framed as a populist economic relief measure, aimed at boosting household income while showcasing the administration’s success in trade negotiations and economic management.

Economic Context: Inflation, Debt, and Growth

Inflation Trends

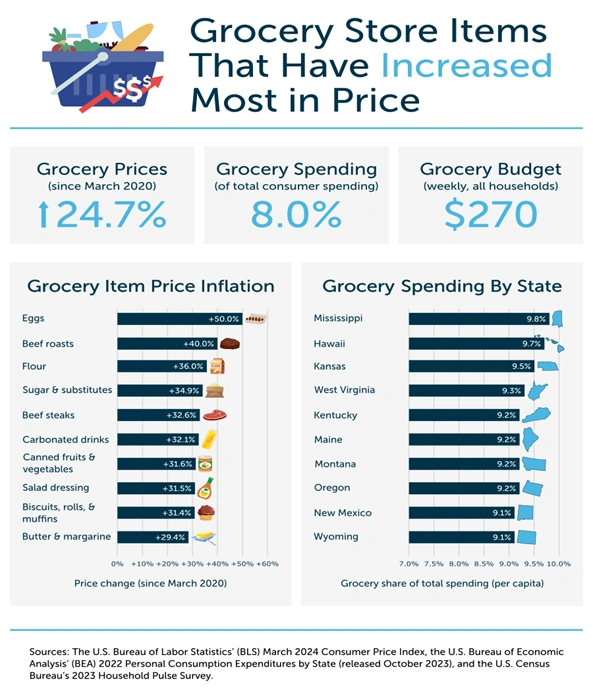

Despite Trump’s claims of “almost no inflation,” recent data shows that U.S. consumer prices rose by 3% in September, up from 2.3% in April when major tariff hikes were introduced. Key categories like groceries and electricity have seen persistent price increases, and job growth has slowed by 23% compared to the same period last year.

National Debt

The U.S. national debt has ballooned to $38.12 trillion. Trump asserts that tariff revenues—allegedly in the trillions—will be used to pay down this debt. Treasury Secretary Scott Bessent confirmed that debt reduction is a top priority, though experts caution that such a move would require congressional approval.

Political Strategy and Legal Challenges

Re-election Messaging

Trump’s tariff dividend is also a strategic pivot in his re-election campaign. His aides have indicated a renewed focus on affordability and economic relief, aiming to resonate with working-class voters who feel squeezed by inflation and stagnant wages.

Legal Scrutiny

The Supreme Court is currently reviewing the legality of Trump’s sweeping tariff policies, with critics arguing that they represent executive overreach. Trump has dismissed these concerns, calling tariffs his “strongest economic weapon”.

How Would It Work?

Distribution Mechanics

While Trump has promised a $2,000 payment to most Americans, no specifics have been provided regarding eligibility, timing, or distribution mechanisms. The lack of clarity raises questions about feasibility, especially given the need for congressional approval and the complexity of allocating tariff revenues.

Comparison to Past Proposals

Earlier in 2025, Senator Josh Hawley proposed a similar measure: a $600 rebate for Americans and their dependent children, funded by tariff revenues. His legislation aimed to ensure that working families benefit from the wealth generated by trade policies.

Global Trade Implications

Tariff Revenues and Trade Relations

Trump’s tariffs have targeted imports from China, the European Union, and other major trading partners. While these measures have generated revenue, they’ve also strained international relations and led to retaliatory tariffs that impact U.S. exporters.

A recent trade agreement with China has eased some tensions, but experts warn that trade wars can flare up again, especially if unilateral tariff hikes continue.

Market Reactions and Investor Sentiment

Stock Market Trends

Despite inflation concerns, the S&P 500 has posted six consecutive monthly gains, marking the longest rally since 2021. Strong corporate earnings, particularly in technology, financial services, and consumer discretionary sectors—have buoyed investor confidence.

However, analysts caution that markets may be overheating, and the long-term profitability of massive investments in AI infrastructure remains uncertain.

CPI and Rate Cuts

The upcoming Consumer Price Index (CPI) report is a key data point that could influence Federal Reserve policy. A hotter-than-expected CPI could delay rate cuts, strengthen the dollar, and pressure equities. Conversely, a softer CPI could reignite rallies across risk assets.

Expert Opinions and Economic Debate

Supporters’ View

Proponents argue that the tariff dividend is a creative way to redistribute wealth generated from trade policies. They see it as a form of economic justice, ensuring that everyday Americans benefit from globalization and industrial policy.

Critics’ Concerns

Economists and legal scholars raise several red flags:

- Lack of transparency in revenue accounting

- Potential inflationary effects from direct cash injections

- Legal hurdles in reallocating tariff funds without congressional oversight

- Risk of trade retaliation from affected countries

Impact on American Households

Short-Term Relief

For many families, a $2,000 payment could provide immediate relief—helping cover rent, groceries, or medical bills. In a high-cost environment, even temporary boosts to disposable income can have meaningful effects on consumer sentiment and spending.

Long-Term Uncertainty

Without structural reforms or sustainable funding mechanisms, one-time payments may not address deeper issues like wage stagnation, housing affordability, or healthcare costs.

What Comes Next?

Key Questions

- Will Congress approve the tariff dividend?

- How will the Supreme Court rule on the legality of Trump’s tariff powers?

- Can tariff revenues truly offset inflation and reduce national debt?

- Will global trade partners retaliate?

Economic Outlook

The U.S. economy remains resilient, but volatility is expected to persist. Inflation, interest rates, and trade dynamics will continue to shape the landscape heading into 2026.

Conclusion

President Trump’s proposed $2,000 tariff dividend is more than a headline—it’s a flashpoint in the ongoing debate over trade, fiscal policy, and economic equity. Whether it becomes law or remains a campaign promise, it reflects a broader shift toward populist economic interventions in an era of uncertainty.

As Americans weigh the promise of direct payments against the risks of inflation and trade disruption, the tariff dividend will remain a defining issue in the months ahead.